The bank transactions are imported automatically allowing you to match and categorize a large number of transactions at the click of a button. This makes the bank reconciliation process efficient and controllable. Ideally, a bank reconciliation should be prepared periodically because it helps to understand the transaction in a much better way. Hope now you know why it is important to reconcile your bank statements and how it can impact the small business accounting directly. There are two main things that companies look for in a bank reconciliation.

- As mentioned above, these include timing differences and unrecorded differences.

- Where there are discrepancies, companies can identify and correct the source of errors.

- This is often done at the end of every month, weekly and even at the end of each day by businesses that have a large number of transactions.

- The goal is to see if there are any inconsistencies present between your balance and the bank’s balance.

A bank reconciliation is a statement prepared for reconciling the balance as per the company’s record to the balance with the bank statement. Once the balances are equal, businesses need to prepare journal entries for the adjustments to the balance per books. To do this, businesses need to take into account the bank charges, NSF checks and errors in accounting. It is mostly recommended if the company is working with minimum cash reserves. This is done by accessing the updates in the bank records through the bank’s website.

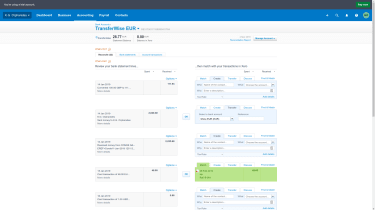

An important point to remember is, when you use cloud accounting software, you may be asked or prompted to “explain” your transactions after they are reconciled. This allows the software to be able to organize the transaction in your accounts. Introducing automation into your reconciliation process will eliminate hours of unnecessary work and help the process be free of human error. Our system enables easy bank imports with the automated matching of ledger transactions to bank feeds. Instead of looking up all the transactions one by one, you can click a button and view the data ready in your interface.

Internal Audit of Home Health Care Industry

For example, if a company writes a check that has not cleared yet, the company would be aware of the transaction before the bank is. Similarly, the bank might have received funds on the company’s behalf and recorded them in the bank’s records for the company before the organization is aware of the deposit. Regardless of whether you’re doing this manually or with the help of software, remember to perform a bank reconciliation process periodically and get the statement. On the other hand, if you add a transaction or accidentally double-count a few transactions, you’ll be liable to pay more tax than you actually require.

The company can now take steps to rectify the mistakes and balance its statements. Accrual is a method in accounting where transactions are recorded as they occur or as they are earned, not considering if there has been a cash payment already. Bank reconciliations are only prepared when the company uses accrual method of accounting.

Harold Averkamp (CPA, MBA) has worked as a university accounting instructor, accountant, and consultant for more than 25 years. He is the sole author of all the materials on AccountingCoach.com. A bank reconciliation is structured to include the information shown in Figure 8.6. At the bottom of your spreadsheet for February, add this note, tracking changes to your balance.

Bank Reconciliation Process Flow

Bank reconciliation is a simple and invaluable process to help manage cash flows. Bank errors are mistakes made by the bank while creating the bank statement. Common errors include entering an incorrect amount or omitting an amount from the bank statement. Compare the cash account’s general ledger to the bank statement to spot the errors.

Such withdrawals would be listed on the bank statement individually. One reason for this is that your bank may have service charges or bank fees for things like too many withdrawals or overdrafts. Or there may be a delay when transferring money from one account to another.

Ideally, you should reconcile your bank account each time you receive a statement from your bank. This is often done at the end of every month, weekly and even at the end of each day by businesses that have a large number of transactions. Adjust the cash balances in the business account by adding interest or deducting monthly charges and overdraft fees. Not only does the bank provide basic checking services, but they process credit card transactions, keep cash safe, and may finance loans when needed. Before we move on let’s stop for a second and understand that it is crucial to enter all your transactions into your business accounting system first and then you can move on to bank reconciliation.

What to Look for When Preparing a Bank Reconciliation?

The information on the bank statement is the bank’s record of all transactions impacting the entity’s bank account during the past month. Preparing a bank reconciliation statement helps you know if customer cheques have bounced, or if the cheques issued were stolen or altered, or even cashed without your knowledge. If you notice fraudulent transactions happening then it is recommended to reconcile the bank statement daily. During the end of the financial year when it is time for an annual audit the auditors examine the company’s bank reconciliation statement as a part of the testing procedure. A few areas where the records might vary from the records maintained by the bank are fees, NSF checks, and recording errors. However, you should also note that the day you close your books probably isn’t the same day that the bank sends its statements, so do your best at balancing the books internally.

After adjusting the balances as per the bank and as per the books, the adjusted amounts should be the same. If they are still not equal, you will have to repeat the process of reconciliation again. The next step is to adjust the cash balance in the business account. To do this, a reconciliation statement known as the bank reconciliation statement is prepared.

Preparing a bank reconciliation requires a company to take a step by step approach. The easiest step by step approach to preparing bank reconciliation is through a 5-step process. If a company has more than one bank accounts, it will need to carry out the process for each account separately. Apart from fraud, bank reconciliation can also help a company detect errors.

Differences are caused by items reflected on company records but not yet recorded by the bank. Examples include deposits in transit (a receipt entered on company records but not processed How to Pay Your Credit Card Bill From Another Bank with steps by the bank) and outstanding checks (checks written which have not cleared the bank). Other differences relate to items noted on the bank statement but not recorded by the company.

Bank Reconciliation Statement

Note that the transactions the company is aware of have already been recorded (journalized) in its records. However, the transactions that the bank is aware of but the company is not must be journalized in the entity’s records. This reconciliation example demonstrates the importance of the process, without which accounting records would soon become unreliable. A. The depositor’s records and the bank’s records are in agreement.

They also can be done as frequently as statements are generated, such as daily or weekly. Non-sufficient funds (NSF) checks are recorded as an adjusted book-balance line item on the bank reconciliation statement. Bank reconciliation statements are effective tools for detecting fraud, theft, and loss. For example, if a check is altered, the payment made for that check will be larger than you anticipate.

Adjusting the Bank Statement Balance

Before you reconcile your accounts, it’s important to be sure that you’ve made all necessary adjustments to your business accounts. You must also make adjustments to reflect income or payments, credit-card charges, and so on. Be aware that conducting a successful bank reconciliation requires careful attention to every detail. The company found there are $3,000 deposits in transit and $2,000 outstanding checks. As mentioned above, deposits in transit are cheques that the bank has not cleared yet. While outstanding checks refer to checks that have been paid by the company but not presented by its suppliers.

Begin by carefully reviewing the bank statement for The Tackle Shop found below. Then look at the company’s check register spreadsheet that follows. Information found on that spreadsheet would correlate precisely to activity in the company’s Cash account within the general ledger.

Therefore, the company must adjust these differences on the bank reconciliation statement. If the company properly identifies all differences and adjusts them, there should be no remaining difference between the bank book and bank statement balances. If there are still some differences, these may be due to errors in either the two balances or the bank reconciliation process. The company may need to repeat the process until the balance becomes zero, or it identifies any errors.